In the ancient myths, gods had all-seeing eyes — they beheld not only actions but intentions, flaws hidden in the heart.

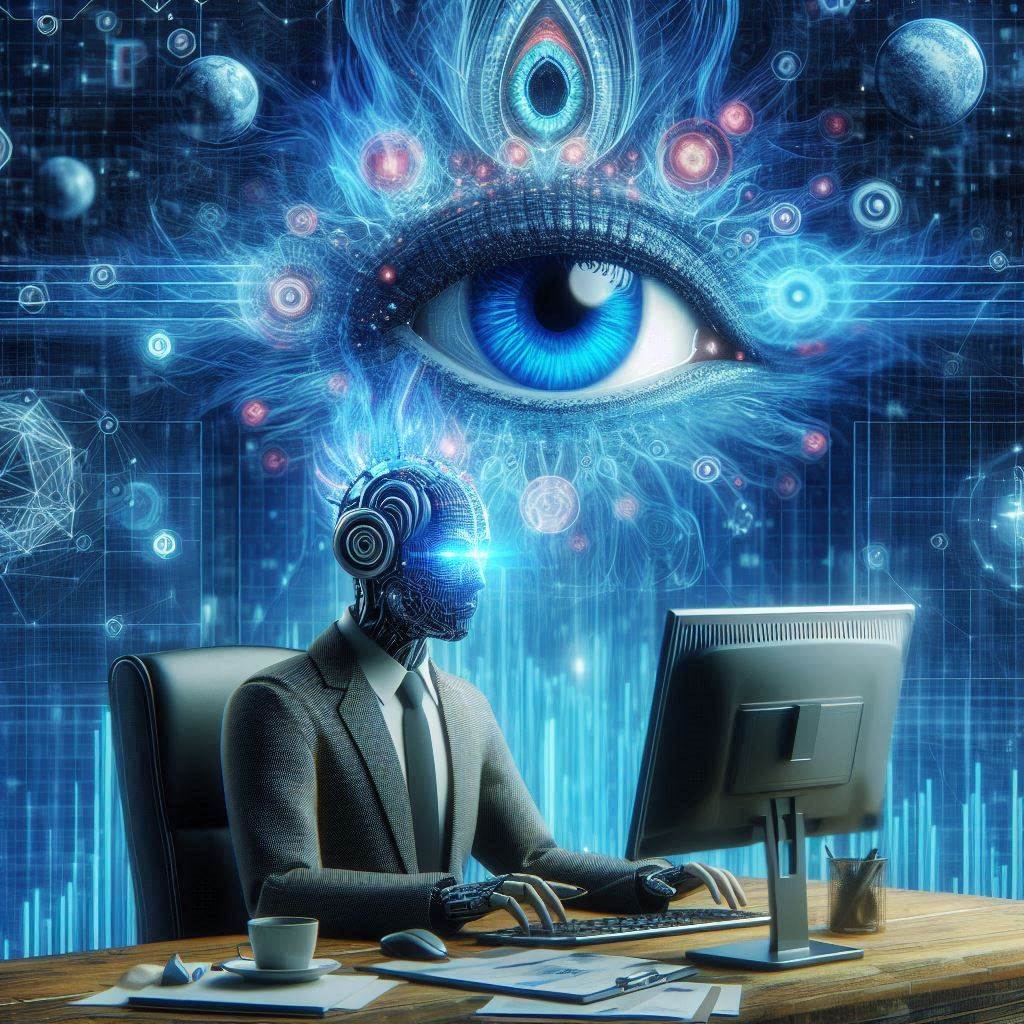

Today, in the rising age of future prop firms, AI-Powered Trader Evaluation Systems embody that legendary sight: detecting unseen skills, dormant risks, and subtle emotional fractures that no human manager could ever perceive.

Let us explore this transformation through metaphors, objections, rebuttals, and visionary glimpses:

1. The Mirror That Reflects the Invisible

- Traditional evaluations are like simple mirrors — they reflect only surface appearances: profit, loss, win rate.

- AI-driven evaluations are enchanted mirrors — they reveal hidden cracks behind success, unnoticed virtues beneath loss.

- Future prop firms will rely on these magical mirrors to find true champions hidden behind imperfect records.

2. The Silent Watcher: Beyond Numbers and Charts

- Human evaluations are like reading a book by its cover.

- AI is the silent watcher: analyzing chapter by chapter, word by word — how a trade is placed, how risk is adjusted, how discipline holds under pressure.

- Every nuance becomes data; every hesitation, a clue; every resilience, a golden thread.

3. Pattern Recognition: The Secret Language of Masters

- Markets are tangled jungles where only masters walk unseen paths.

- AI systems recognize these secret trails — recurring behaviors of true skill that even the trader themselves might not know they possess.

- Future prop firms will use AI not just to reward profits, but to discover future legends before they fully bloom.

4. Objection: “But AI Lacks Human Intuition!”

- Critics argue that AI can never understand human nuance and context.

- Rebuttal: AI does not replace human intuition; it augments it, like a telescope revealing stars invisible to the naked eye.

- In the world of future prop firms, human and machine insights will dance together in unprecedented harmony.

5. Objection: “Won’t Traders Feel Dehumanized?”

- Some fear being judged by cold algorithms rather than warm mentors.

- Rebuttal: True AI-powered systems are designed not to dehumanize but to decode humanity — preserving individuality while protecting firms from hidden risks.

- Far from feeling diminished, traders will feel seen more deeply than ever before.

6. The Orchestra Conductor: Harmonizing Strengths

- Imagine a conductor who not only listens to music but sees every vibration of every note.

- AI acts as this supreme conductor — spotting which traders excel at volatility, who shine in trends, who crumble under uncertainty.

- Funding and roles within future prop firms will be fine-tuned to each trader’s unique “instrument.”

7. The Lighthouse on the Hidden Reef

- A ship might sail smoothly until it crashes into a reef hidden beneath the waters.

- AI-powered evaluation serves as a lighthouse, warning of behavioral reefs — impulsive risk-taking, fear-based exits, greed-driven overtrading — before disaster strikes.

- This preventive insight is priceless in safeguarding both the trader’s career and the firm’s capital.

8. Future Prop Firms: Evolution into Cognitive Ecosystems

- Future prop firms will become cognitive ecosystems — networks where AI senses, interprets, and nurtures trader growth in real time.

- Evaluation will no longer be an annual audit but a living dialogue between trader and machine:

- “Here you grew.”

- “Here you lost focus.”

- “Here lies your hidden edge.”

AI-Powered Trader Evaluation Systems will elevate trading from a game of guesswork into an art of precision.

They will peer beneath the visible outcomes and trace the hidden patterns of skill, discipline, and future greatness.

In the thriving worlds of future prop firms, success will not just be measured by today’s profits — but by the invisible seeds of tomorrow’s mastery, discovered and nurtured by the unseen eye of AI.